Yotta Savings seems to think so.

Founders Adam Moelis and Ben Doyle have built a platform that gives users 1 ticket for every $25 they save in their Yotta Savings account, with each ticket entered in the weekly drawing that offers the chance to win between 10 cents and 10 million dollars.

Seems great right? So what’s the catch?

Well, there really is none.

Prize-linked savings accounts (PLSA) are hardly a new concept and have existed in some variation dating back to the U.K.’s Premium Bonds program which originated in 1956.

In fact, that’s where the idea from Yotta came from.

According to Adam:

“We were inspired by a Freakonomics podcast about the concept of prize-linked savings as well as the Premium Bond program in the UK. Premium Bonds is a prize-linked savings program that has been run by the UK government since the ‘50s. It’s the no. 1 savings vehicle in the country. Over 33% of the population participates, with over $100B deposited into the program.”

So what makes Yotta so ingenious?

Americans spend over $80 billion a year on the lottery (source), but 40% of people can’t come up with $400 in case of an emergency (source). Moreover, savings accounts with traditional banks like Chase and Bank of America offer a paltry 0.01%-0.03% on their savings products.

Yotta not only blows that out of the water by offering 0.2% on all deposits plus the value of your prizes, but it also managed to take something boring like a savings account and make it fun.

It’s that behavioral psychology element that really sets it apart from traditional bank accounts. And it really works. I’ve been using Yotta for 4 weeks now and each day I find my self looking forward to the nightly drawings.

You might be wondering, “Aren’t I better off just using high-interest savings accounts like Ally, Marcus, or Wealthfront?”

Probably not. With the federal interest rates in the toilet, even the likes of Ally, Marcus, and Wealthfront have slashed their interest rates to 0.8%, 0.6%, and 0.35%, respectively.

With a 0.2% rate on all deposits with Yotta, plus the ability to earn prizes, mathematically speaking you’re much more likely to come out ahead using Yotta.

In fact, your effective APY should be around 3%+ depending on your prize winnings.

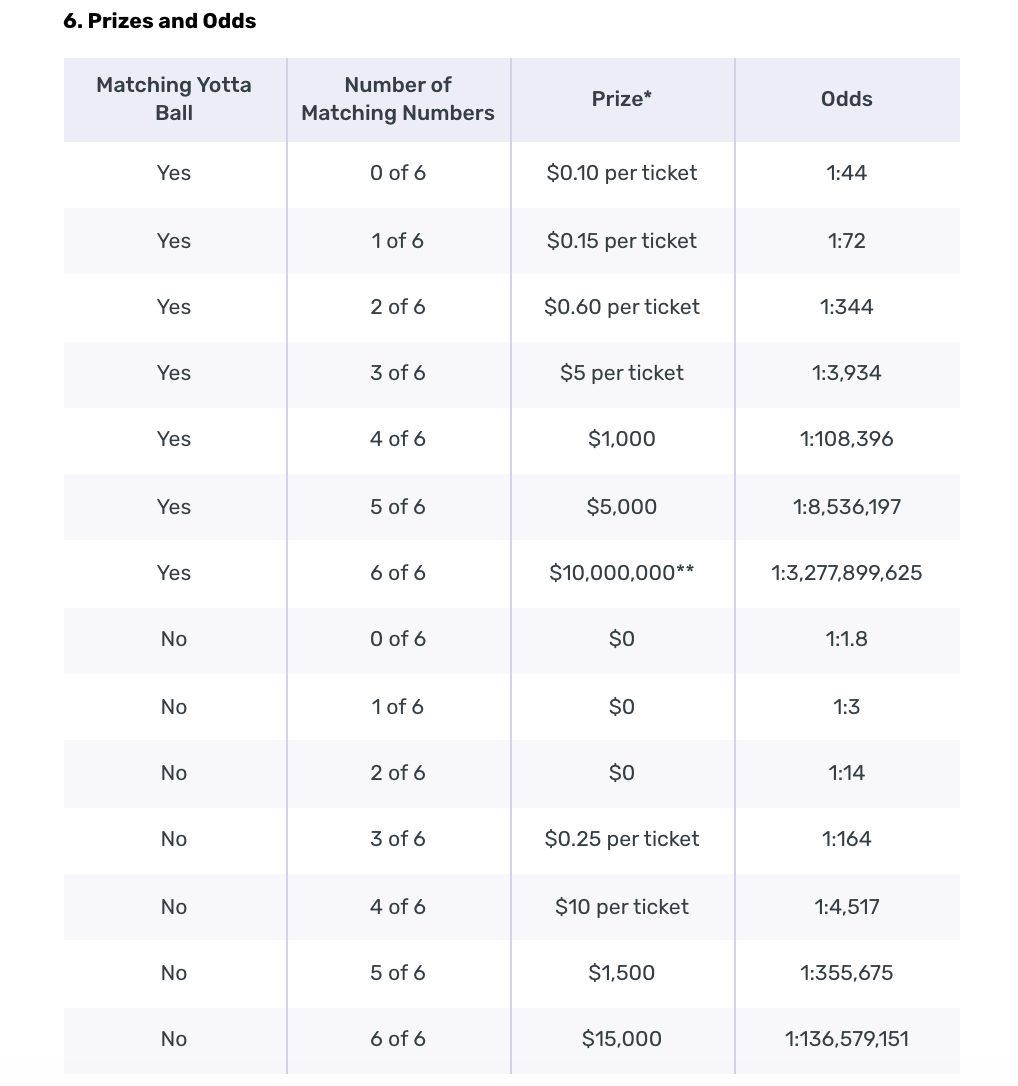

If you want to dive into the math to calculate your expected value per ticket, here are the probabilities of winning each prize straight from the Yotta website. Keep in mind that prize amounts of $1,000+ are split between the number of winning tickets.

If you prefer a faster approach, you can use this google doc created by AskSebby to quickly calculate your expected APY.

In the past month, I’ve won $37.33 in guaranteed interest and prizes. This represents an expected APY of 4.48% if I continue to win similar amounts each month.

All in all, the product works great, is lucrative, and is a downright fun solution to a traditional savings account.

What do you think? Do Prize-linked savings accounts have a bright future? Or will consumers prefer the status quo of traditional banking?

If you’re interested in signing up for a Yotta Savings account you can use my link to get 100 bonus tickets. (Note: This is a personal referral link. I am not being compensated by Yotta. Everything stated is purely my opinion.)

Check out the Yotta FAQ page for any questions you might have that I did not address here.

If you’re interested in weekly emails with content similar to this then please consider subscribing.

News I’m Reading

Chamath Palihapitiya’s SPAC Social Capital Hedosophia II will acquire Opendoor, an online marketplace for buying and selling houses, at a valuation of $4.8 billion.

Mad Money host Jim Cramer forecasts a generational wealth storage shift, and considers Bitcoin an inflation hedge.

Want to buy a share of Blue-chip art? The Masterworks platform allows you to do just that at as low as $20 a share.

Swedish payment provider, Klarna, is now officially Europe’s highest valued private fintech company at a valuation of $10.6 billion.